omaha ne sales tax rate 2019

How The County Inheritance Tax Works Nebraska S Sales Tax 2020 The Year Of The Roth Ira Conversion Lutz Financial Nebraska Tax Rates. Ad DAVO Sets Aside Files Pays Your Sales Tax On Time So You Can Focus On Your Business.

Property Taxes Explained Omaha Relocation

Edward will increase by 15 bringing the combined rate to 7.

. Also effective October 1 2022 the following cities. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local Sales and Use Tax Rates Effective April 1 2021. February 2019 55.

Paul 10012000 10 Sargent 04012019 20 0401201315 0101200710. Omaha NE Sales Tax Rate. Sales Tax Rate Finder.

Below 100 means cheaper than the US average. Coleridge Nehawka and Wauneta will each levy a new 1 local sales and use tax while the city of St. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

North Omaha 5730 S. Nebraska Tax Rate Chronologies Jurisdiction Effective Date Rate Jurisdiction Effective Date Rate Jurisdiction Effective Date Rate Table 5 Local Sales Tax Rates Continued Rushville 0401201515 1001198210 St. The Nebraska state sales and use tax rate is 55 055.

Tax Commissioner Tony Fulton announced the following changes in local sales and use tax rates for the upcoming quarter starting on April 1 2019. There is 0 additional tax districts that applies to some areas geographically within Nemaha. 100 US Average.

AP Republican gubernatorial challenger Tim James on Wednesday called for a repeal of Alabamas 2019 gas tax. Nebraska sales tax changes effective July 1 2019. The Nebraska state sales and use tax rate is 55 055.

For tax rates in other cities see Texas sales taxes by city and county. A new 05 local sales and use tax takes effect bringing the combined rate to 6. There are a total of 334 local tax jurisdictions across the state collecting an average local tax of 0825.

Groceries are exempt from the Omaha and Nebraska state sales taxes. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 75. Get Your First Month Free.

The following rates apply to the DOUGLAS. Real property tax on median home. Request a Business Tax Payment Plan.

The 825 sales tax rate in Omaha consists of 625 Texas state sales tax 05 Morris County sales tax and 15 Omaha tax. Omaha collects a 15 local sales tax the. Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2.

Several local sales and use tax rate changes will take effect in Nebraska on July 1 2019. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022 updated 06032022 Effective October 1 2022 the village of Bruning and the city of Humboldt will start a local sales and use tax rate of 15. The latest sales tax rates for cities in Nebraska NE state.

January 2019 55. Plattsmouth NE Sales Tax Rate. Groceries are exempt from the Nebraska sales tax.

Omaha has three DMV locations for drivers licenses. 2020 rates included for use while preparing your income tax deduction. Sales and use tax in the city of St.

The Nebraska state sales and use tax rate is 55 055. Sales tax region name. More are slated for April 1 2019.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2022. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax. Sales and Use Tax.

The Omaha Sales Tax is collected by the merchant on all qualifying sales made within Omaha. Sales Taxes In The United States Wikiwand Sales Taxes In The United States Wikiwand Nebraska S Sales Tax Sales Taxes In The United States Wikiwand. Rates include state county and city taxes.

City Tax Special Tax. Make a Payment Only. For tax rates in other cities see Nebraska sales taxes by city and county.

Edward 07012019 15 0101200910 St. Nebraska has 149 special sales tax jurisdictions with local sales taxes in addition to the state. How to outsmart the line at the DMV.

The local sales tax rate in Omaha Nebraska is 7 as of August 2022. Several local sales and use tax rate changes took effect in Nebraska on January 1 2019. January 2019 sales tax changes.

Sales Tax on Food. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. Offutt Air Force Base NE Sales Tax Rate.

Millard and 2910 N. State Tax Rates. You can print a 825 sales tax table here.

The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. Omaha ne sales tax rate 2019 Sunday July 31 2022 Edit. Ad Try Returns For Small Business Avalaras low cost solution built for omnichannel sellers.

Tax rates last updated in August 2022. Omaha Nebraska and Lincoln Nebraska Change Places. Average Sales Tax With Local.

Nebraska state sales tax. Several local sales and use tax rate changes take effect in Nebraska on July 1 2019. Coleridge Nehawka and Wauneta will each levy a new 1 local sales and use tax bringing the total sales and use tax rate in each city to 65.

Omaha collects the maximum legal local sales tax. Papillion NE Sales Tax Rate. There is no applicable special tax.

Nebraska Sales Use Tax Guide Avalara

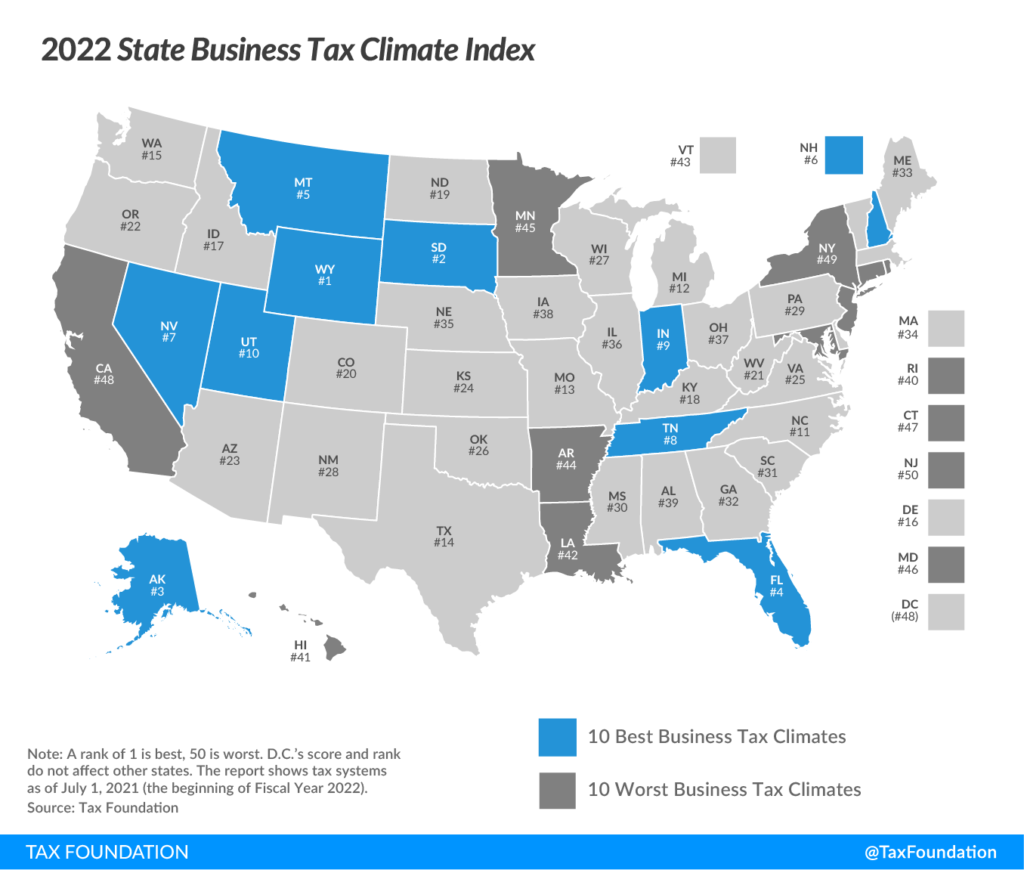

Nebraska Drops To 35th In National Tax Ranking

Sales Tax On Cars And Vehicles In Nebraska

Sales Tax Rates In Major Cities Tax Data Tax Foundation

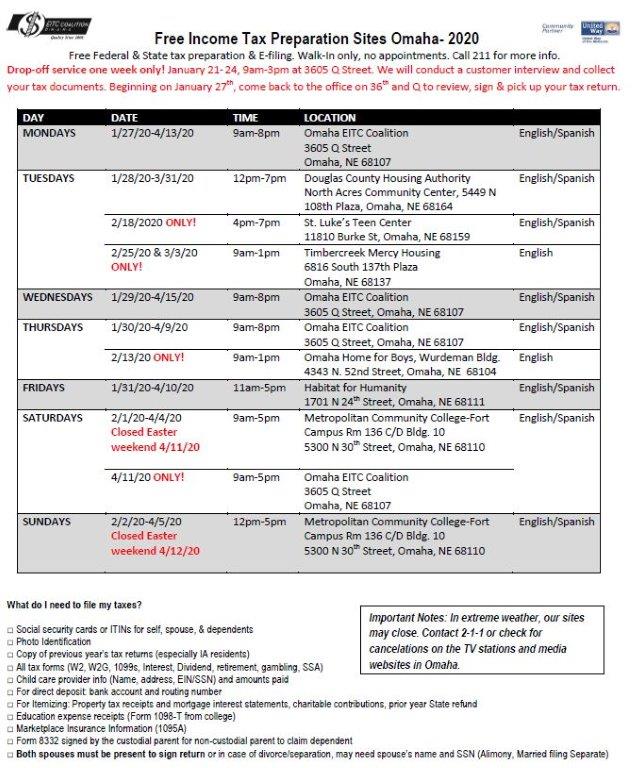

Free Tax Preparation Sites In Omaha Nebraska Department Of Revenue

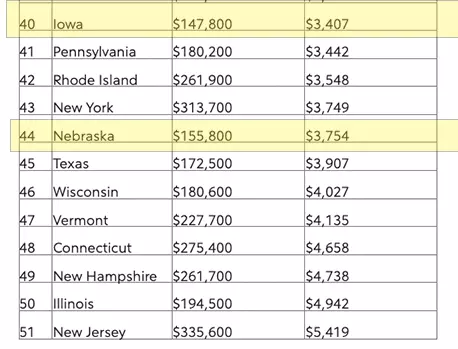

New Ag Census Shows Disparities In Property Taxes By State

Cryptocurrency Tax Calculator Forbes Advisor

Sales Taxes In The United States Wikiwand

Cell Phone Tax Wireless Taxes Fees Tax Foundation

6917 Halsey Dr Shawnee Ks 66216 Realtor Com

Sales Taxes In The United States Wikiwand

Should You Move To A State With No Income Tax Forbes Advisor

Sales Taxes In The United States Wikiwand